Has the dramatic rise in Rotherham property prices of the last six years come to an end? Many economists (as well as the general public) agree that it has, but is this true? And either way, what does this mean for landlords?

If you read the national newspapers you’ll probably see a talk of doom and gloom in the British housing market. They talk about things such as strained buyer affordability (property prices have increased faster than average salaries), a lack of properties being built and Brexit uncertainties. They blame these factors on the slow down. Yet in the last 12 months people have still been moving, buying and selling in Rotherham at similar levels to the last six years. Perhaps the newspapers have been trying to create ‘bad news’ to sell their papers?

Instead, let’s look at what is really happening in our local property market.

Who is moving and why?

In the last twelve months most of the property sales in Rotherham involved semi-detached properties, which sold for on average £130,400. Terraced properties sold for an average price of £98,100, while detached properties fetched approximately £238,550.

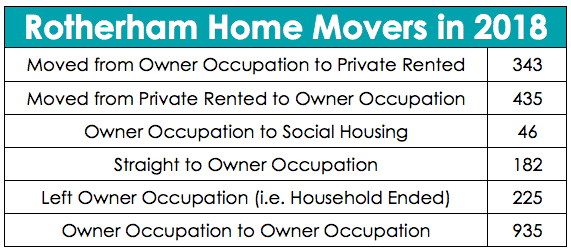

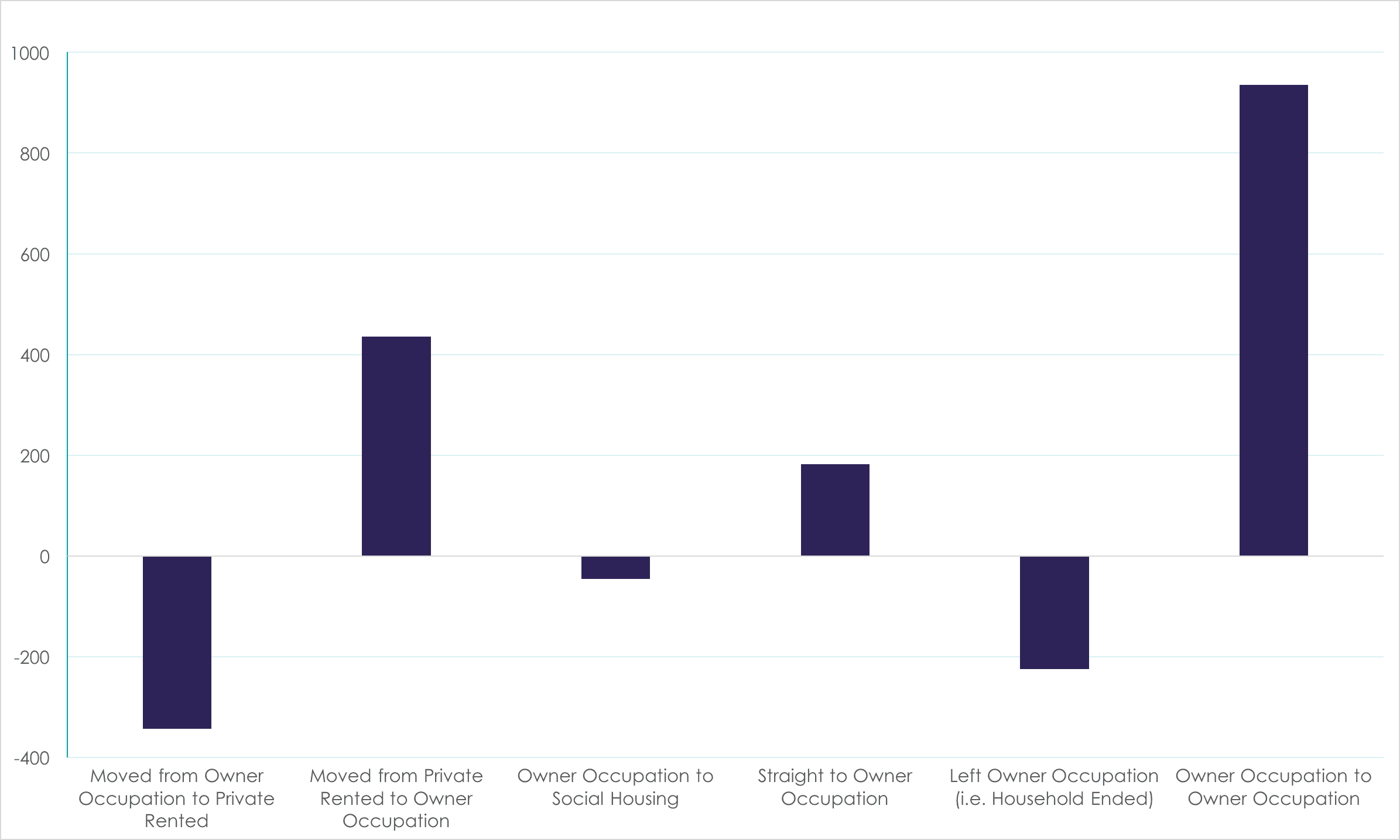

In the homeowner sector in 2018 (i.e. owner occupation), 935 households moved within the tenure (i.e. sold the home they owned and bought another one) and 182 new households were created (i.e. they moved from living with family/friends and bought their first home without privately renting).

What does this mean for buy-to-let landlords in our area?

Looking at the graph, it appears to be bad news for landlords. There were 435 households that moved into the home owning (owner occupation) tenure from the private rented sector, whilst on the other side of the coin, 343 Rotherham households moved to the private rented sector from owner occupation. On the face of it, this appears to be a a reduction in the private sector.

However, our own research shows that in addition to the above statistics, an additional 253 households in the private rental sector in Rotherham were created in 2018. We believe that these will continue to grow at those levels for the foreseeable future.

We have one final thought that could be a great opportunity for local property investors. 225 owner occupied households in our area sold in the last year where the homeowners passed away. These properties can be a potential goldmine and offer great returns because some of the older generation who have owned these homes for decades have spent money on high capital items such as double glazing and central heating but not on lower ticket items such as up-to-date carpets and decoration. These properties can often be bought more cheaply because most buyers can’t see past the brown bathroom suite from the 1970s. If you buy wisely, you might be able to generate a good rental yield.

Launching our brand new property investment deals page

To help you out, we’ve launched our very own property investment deal page right here on the Bricknells website. We’re posting property tips for investors looking to expand their portfolio – hopefully we can point you in the direction of a bargain or two!

And ultimately, whatever is happening in the world at the moment, the Rotherham housing market is looking in decent shape for the medium to long term. Like we say to anyone buying a property, whether you are a landlord, first time buyer or homeowner… property is a long game. If you play the long game, you will always win.

As always, if you need any help, please get in touch with us – we’re happy to help and advise!