There’s been another delay to Brexit and more uncertainty for the UK – at least this time politicians have until 31st October to sort out this tricky mess! With Brexit in mind we wanted to look at the Rotherham property market. Is Brexit having a negative effect or are things continuing as before? It’s important for landlords to have this picture in mind as we continue to navigate through this potentially uncertain political and economic time.

How did Brexit impact the property market in 2018?

At the end of last year, we suggested property values in Rotherham would be between 1.3% and 2.3% different by the end of the year. It might surprise some people that Brexit hasn’t had the impact on the Rotherham property market that most feared at the start of 2018.

The basis of this point of view can clearly be seen in the number of property transactions (i.e. the number of property sold) that have taken place locally since 2008. The most recent property recession was the Credit Crunch between 2008-2010.

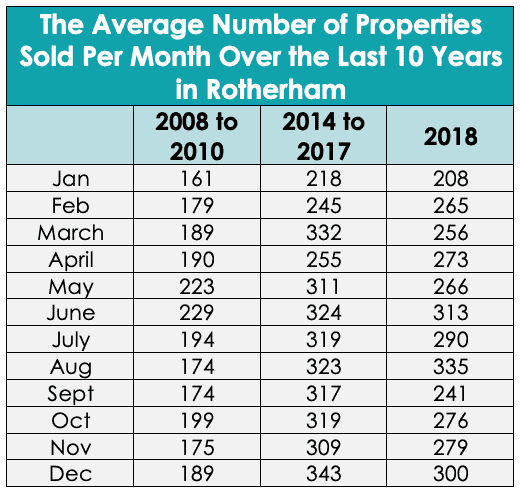

We decided to look at the 2018 statistics, and compare them with the Credit Crunch years (2008 to 2010) and the boom years (2014 to 2017). The results can be seen in this table:

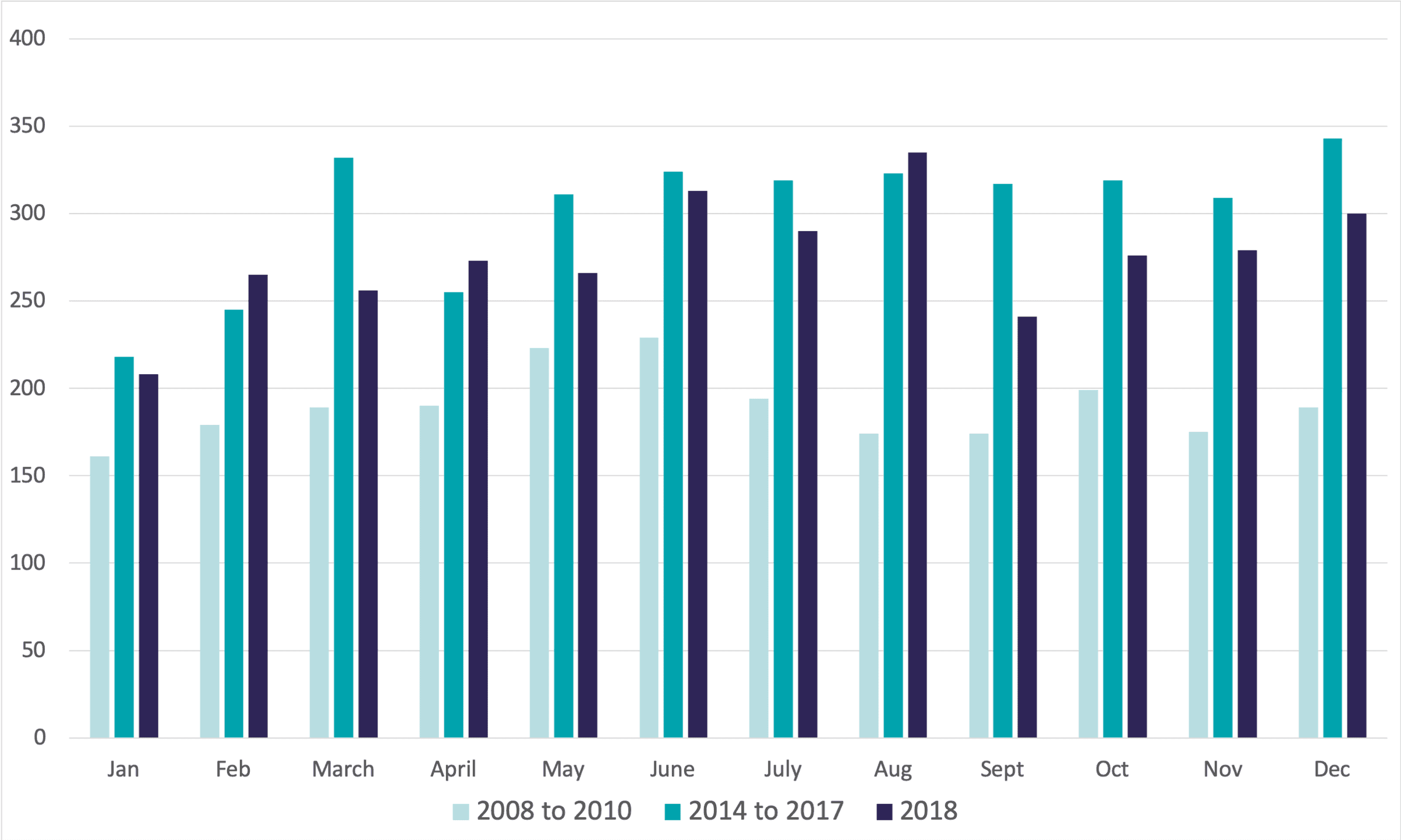

From here we looked at the average quarterly figures for those chosen date ranges and created this chart:

In that 2008 to 2010 property recession, the average number of properties sold in the our area were 190 per month. Interesting when we compare that to the boom years of 2014 to 2017, when an average of 301 properties changed hands monthly. Last year, an impressive average of 275 properties changed hands monthly, still 45.1% higher than the Credit Crunch years of 2008 to 2010, despite the small drop compared to previous years.

Brexit is an unwelcome distraction from the real issues

The simple fact is the fundamental problems of the Rotherham property market are that there haven’t been enough new homes being built since the 1980s. Furthermore, the cost of buying your first home remains relatively high compared to wages and there have been tougher mortgage rules since 2014.

It is these issues which will ultimately determine and form the rather unexciting, yet still vital, long term outlook for the Rotherham (and national) housing market. The Brexit issue is just a diversion away from the real issues that we need to worry about. Assuming something can be sorted with Brexit (eventually!), in the long term property values in Rotherham will be constrained by earnings increases with long term house price rises of no more than 2.5% to 4% a year.

Landlords: “Should I wait to buy or not?”

This is the question landlords keep asking us. Do we wait for Brexit to get sorted or do we buy now?

Well, our answer is often a question: where else are you going to invest your money? We have already mentioned that we aren’t building enough homes to keep up with demand… so as demand outstrips supply, house values will continue to grow. Putting the money in the building society will only get you 1% to 2% if you are lucky. Property remains an excellent investment.

Furthermore, in the short term, there could be some bargains to be had from shortsighted panicking sellers. There are often great opportunities to be had and this is why we keep posting property recommendations here.

What might be happening is that normal homebuyers are putting off moving due to Brexit. Therefore, when the Brexit issues are finally sorted out in October (or sooner!) we may see a release of that pent-up demand to move home, increasing the price for buy-to-let landlords and investors.

At the end of the day, it’s your decision, but we will always be on hand to analyse the statistics and provide advice where needed! Please get in touch if you have any questions.