Recent set of data from the Land Registry has stated that property values in Rotherham and the surrounding area were 1.58% higher than 12 months ago and 9.12% higher than January 2015. Despite the uncertainty over Brexit, the property values in Rotherham are continuing their medium and long-term upward trajectory. As economics is about supply and demand, the story behind the Rotherham property market can also be seen from those two sides of the story.

Supply-side Issues

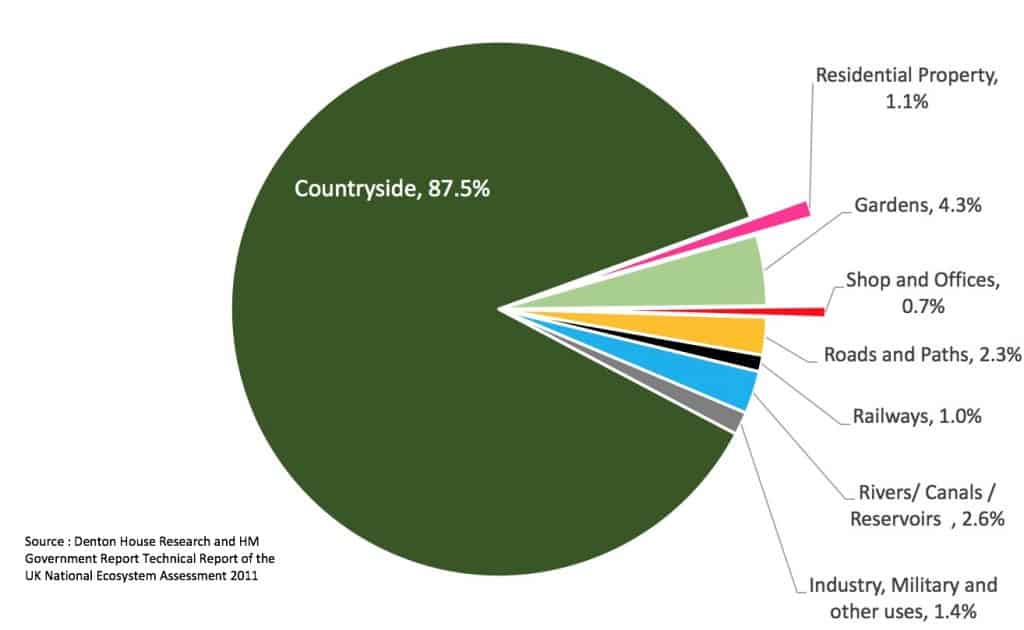

The supply issues of the Rotherham property market and putting aside the short-term dearth of property on the market, one of the main reasons of this sustained house price growth has been down to of the lack of building new homes. The draconian planning laws over the last 70 years (starting with The Town and Country Planning Act 1947) have meant the amount of land built on in the UK today still stands at an unbelievably small 1.8%. That figure is made up of 1.1% with residential property and 0.7% for commercial property.

The following pie chart shows how land in the UK is actually used:

This shows that restrictive planning regulations are meaning that homes that people of Rotherham need aren’t being built. Adding fuel to the fire, landowners have deliberately sat on land, which has kept land values high in turn keeping house prices high.

Demand-side Issues

Looking at the demand side of the equation, one might have thought property values would drop because of Brexit and buyer’s uncertainty. However, certain commenters now believe property values might rise because of Brexit. Many people are risk adverse, especially with their hard-earned savings. The stock market is at an all-time high (ready to pop again?) and many people don’t trust the money markets. The thing about property is its tangible, bricks and mortar, you can touch it and you can easily understand it. Brits have historically put their faith in bricks and mortar, which they expect to rise in value, in numerical terms, at least.

Nationally, the value of property has risen by 635.4% since 1984 whilst the stock market has risen by a very similar 593.1%. However, the stock market has had a roller coaster of a ride to get to those figures. For example, in the dot com bubble of the early 2000s, the FTSE100 dropped 126.3% in two years and it dropped again by 44.6% in 9 months in 2007… the worst drop Rotherham saw in property values was just 16.94% in the 2008/9 credit crunch.

Despite the slowdown in the rate of annual property value growth in Rotherham to the current 1.58%, from the heady days of 4.88% annual increases seen in mid 2010, it can be argued the headline rate of Rotherham property price inflation is holding up well, especially with the squeeze on real incomes, new taxation rules for landlords and the slight ambiguity around Brexit.

Now that mortgage rates are at an all-time low and tumbling unemployment, all these factors are largely continuing to help support property values in Rotherham (and the UK).

To keep up to date with all our latest news, why not follow us on Twitter or like our Facebook page.