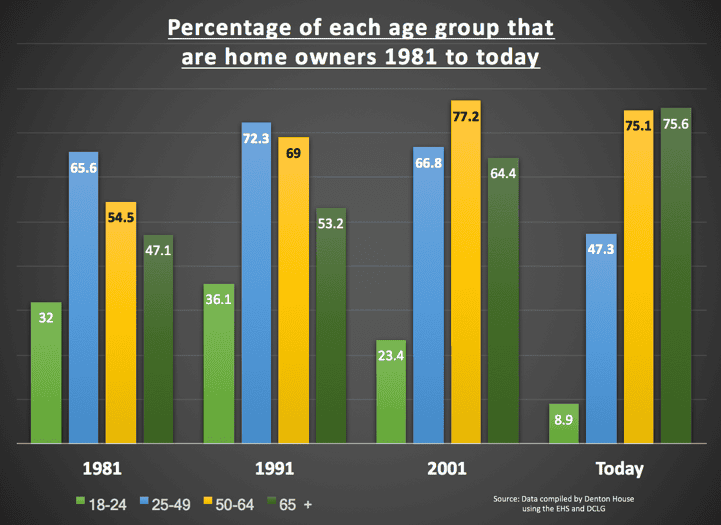

Looking at the UK as a whole, this graph shows the percentage of each age group that are homeowners from 1981 to today.

Over 75 percent of Brits aged 65 and above are owner-occupiers, the biggest share since records began and a proportional rise of over 48.3% since the early 1980s. Looking at that age bracket and roll the clock back 36 years (to when they were in their 30s and 40s) and two thirds (65.6%) of them owned their own home.

However, today just under half of 25 to 49 year olds (47.3%) own their own home. Plus, the biggest drop has been in the 18 to 24-year old’s, where homeownership has dropped from a third (32%) in the 1980s to less than one in ten (8.9%) today.

What’s the situation in Rotherham?

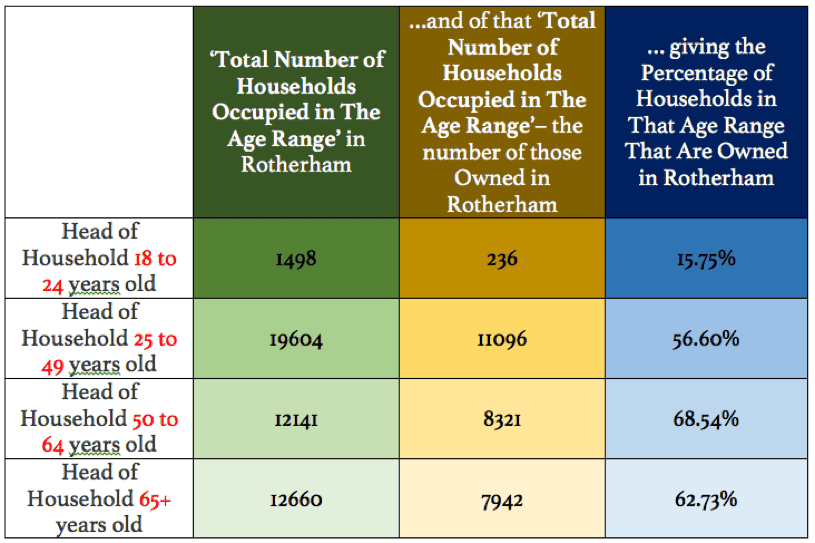

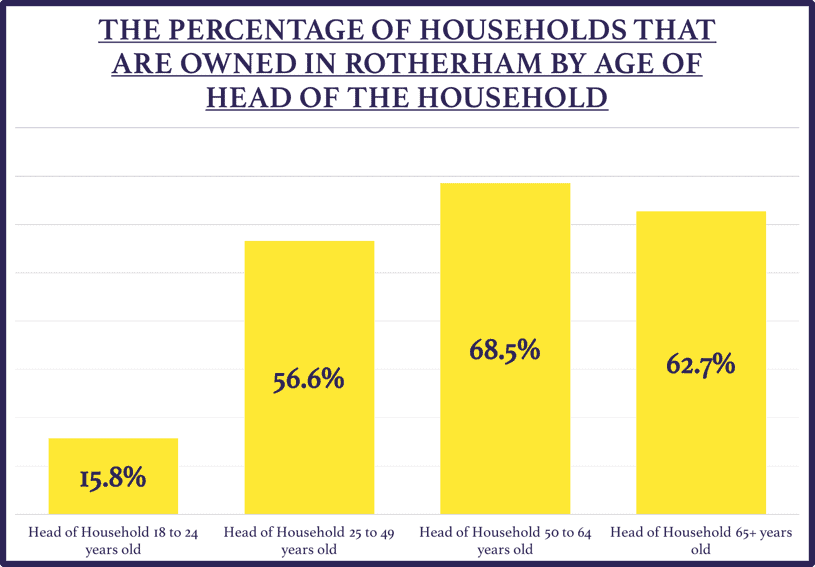

Looking at the Rotherham statistics, the numbers make more interesting reading:

18 to 24 year olds are still significantly less likely to own a house compared to the older generations.

So why is this happening? Why are younger generations being left out?

Government policy contributes to the generational stalemate.

Stamp Duty rules prevent older Brits from moving as the price of land and planning rules make it harder to build affordable bungalows that are attractive to members of the older generation who want to move.

The average value of an acre of prime building land in the UK is between £750,000 and £800,000 per acre.

Bungalows are the favoured option for the older generation, but the problem is bungalows take up too much land to make them profitable for new homes builders. The housing market is gridlocked with youngsters wanting to get on (then move up) the property ladder whilst the older generation, who want to move from their larger houses to smaller, more modern bungalows, can’t.

The problem is there simply aren’t enough bungalows being built and the high price of land, means that they are prohibitive to build.

One solution could be to start to talk to your local councillors, so they can mould the planners’ thoughts and the local authority thinking in setting land aside for bungalows instead of two up two down starter homes? That would free the impasse at the top of the property ladder (i.e. mature people living in big houses but unable to move anywhere), releasing the middle aged gridlocked people in the ladder to move up, thus releasing more existing starter homes for the younger generation.

To keep up to date with all our latest news, why not follow us on Twitter or like our Facebook page.

If you are an investor or landlord that is interested in our services, please don’t hesitate to contact the office on 01709 365 584.