It’s our opinion that buy-to-let investment in Rotherham, in the long term, will bring substantial returns for landlords, irrespective of the latest regulation and tax changes.

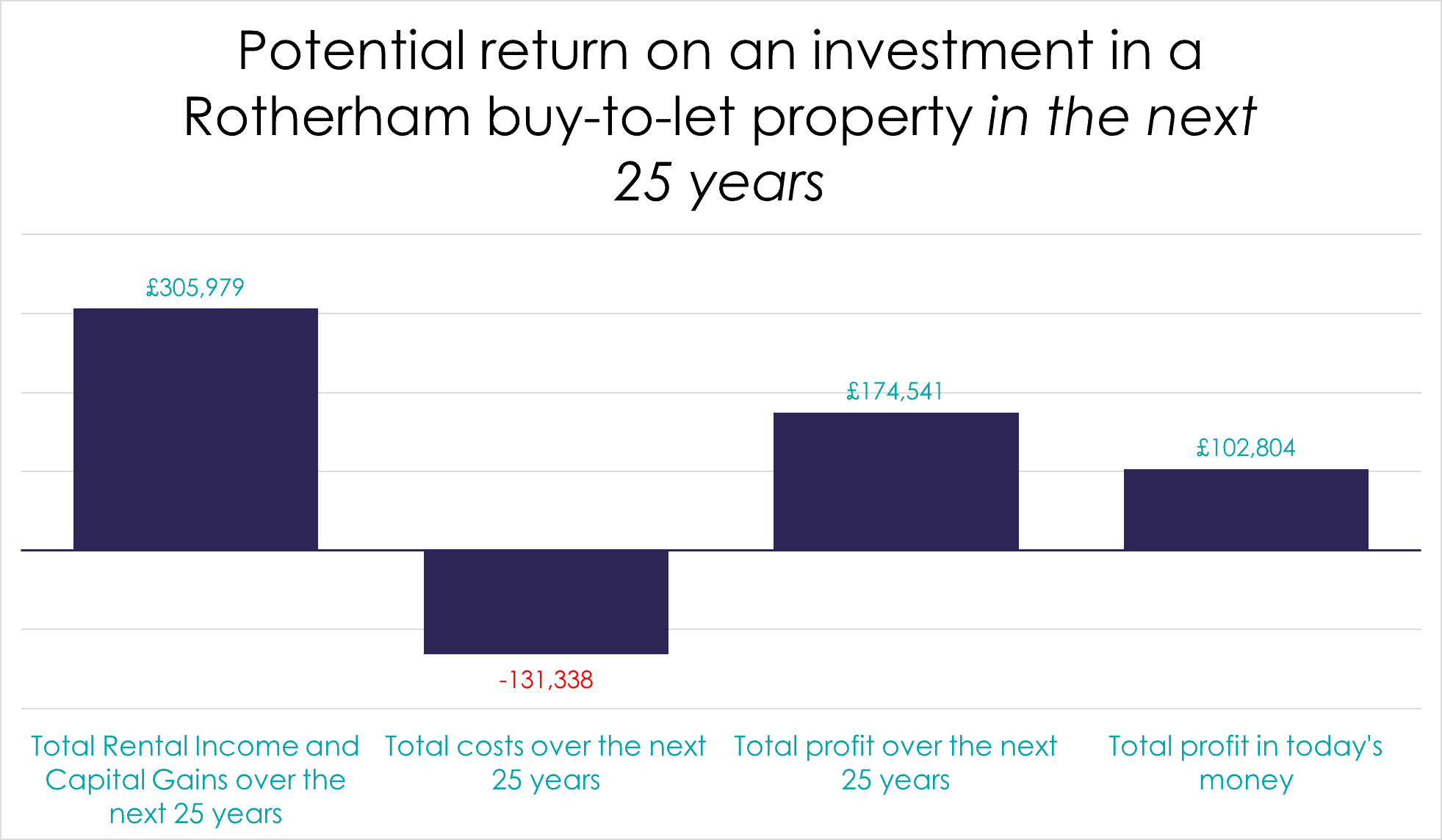

But just how much could landlords make in the next 25 years? We’ve looked at an average £93,000 terraced/town house property purchased with a 25% deposit and worked out how much a basic tax-paying landlord might make. Taking a very conservative view, landlords could see a projected net profit of £174,541 per property over this time period through capital gains and rental. When inflation is taken into account that works out at £102,804 (in today’s money) – around £4,112 per year.

Capital gains make up a substantial part of a landlord’s returns

Capital gains are a key part of a landlord’s profit. Again, being very conservative, we have assumed that Rotherham house prices between now and 2043 will rise at half the rate they did between 1993 and 2018 (the preceding 25 years). Therefore our example Rotherham property would grow in value from £93,000 to £192,464, providing gross capital gains of £99,464.

How much rent will a landlord make?

A typical Rotherham landlord receives, an average rent of £5,400 per annum per terraced/town house property. As a result, over a 25-year period, the above property would generate a total rental income of £206,415 (again, this is very conservative estimate assuming a compound annual growth rate in the rent of 1.71% per annum).

What about the costs to running a buy-to-let property?

There are of course costs to running a buy-to-let property, including mortgages, void periods, repairs, agents fees etc. We’ve estimated that these costs will be £131,338 – the result is the aforementioned net profit level of £174,541.

Now of course we’ve made assumptions to reach these figures, but we have tried to be very unadventurous with those assumptions!

The buy-to-let property market here in Rotherham and across the UK is experiencing a massive sea of change. Regulation and tax changes have altered the dynamic in the property market, diminishing its appeal to inexperienced and amateur landlords, and these new tax changes can mean higher tax bills for higher rate tax landlords. Yet, despite these rising costs, there are still healthy returns to be found in Rotherham buy-to-let investment for knowledgeable and steadfast landlords. That’s why more and more landlords are contacting Bricknells Rentals for expert help when it comes to their property – you can find out more about our services, including our fully managed service, by visiting our dedicated landlord page of this website.

Buy-to-let is a long-term business undertaking, necessitating commitment and expertise. Don’t put your head in the sand and think it doesn’t affect you.

Landlords must be equipped to start business and tax planning, take portfolio management advice to ensure their investments will meet their investment goals, appreciate the risks as well as the rewards, and, most crucially, understand the obligations they have towards their tenants. These are all things that we can help you with.

If you are a Rotherham landlord, irrespective of whether you are a client at Bricknells Rentals, feel free to get in touch with us for an informal chat on the future direction of the Rotherham rental market and where opportunities may lie – our expert advice can really help you take your property portfolio to the next level.