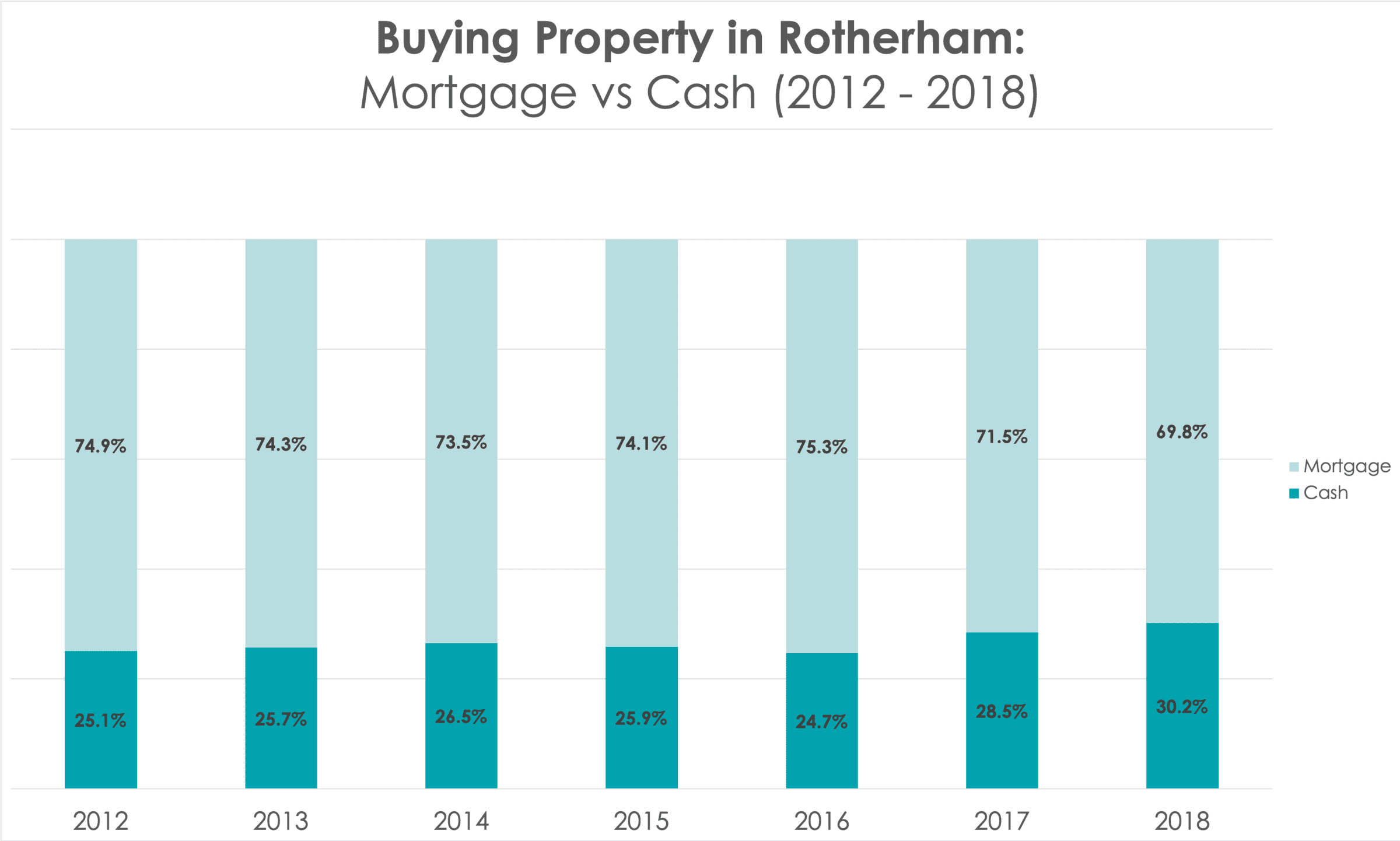

For most Rotherham people, a mortgage is the only way to buy a property. However, for some buy-to-let landlords or homeowners who have paid off their mortgage, they have the choice to pay exclusively with cash. Looking at the numbers locally, there was actually over a quarter of all properties bought in our area that were purchased without a mortgage.

The question for landlords in this position is whether you should you use all your cash or whether a mortgage be a more suitable option.

First let’s examine those local numbers. The total number of sales in the last 7 years was 22,441 and of these sales, 5,974 were made without a mortgage. This is an impressive 26.6%. However, this statistic is actually less than the national average where nearly a third (31.9%) were cash purchases during the same time period.

From the graph below you can see that the level of cash purchases against mortgage purchases has remained reasonably constant over those seven years.

Variable or fixed: which mortgage would you get?

Before considering the merits of a cash purchases against a mortgage purchase, it is important to consider what mortgage is on offer: would you fix the rate or have a variable rate mortgage? In the last quarter, 90.57% of people who took out a mortgage chose a fixed rate mortgage with an average interest rate of 2.27% so the trend is definitely in that direction (overall 65.79% of mortgages are on a fixed rate).

The level of mortgage debt compared to the value of the home itself (referred to as the Loan to Value rate – LTV) was interesting, as 61.9% of people with a mortgage have a LTV of less than 75%. Although, one number that did jump out at me was only 4.33% of mortgages are 90% and higher LTV – meaning if we do have another property slump, the number of people in negative equity will be relatively small.

The pros and cons of a Rotherham buy-to-let landlord taking out a mortgage

The main benefit for the buy-to-let landlord who chooses the mortgage route is that this will help them to increase their investment across more properties, thus maximising the opportunity for a greater return. Conversely, if you choose to put all your cash into one property then your investment will be restricted to that property. Having more than one property in your portfolio is beneficial as this means that if there is a void in the tenancy, there will still be rent coming in from other properties.. The flip side of the coin is that there is a mortgage to pay for whether or not the property is let.

The other great motivation for landlords to take a mortgage is that they can set the mortgage interest against the rental income. However, that will only be at the basic rate of tax by 2021 due the recent tax changes. Furthermore, Banks and Building Societies will characteristically want at least a 25% deposit (meaning Rotherham landlords can only borrow up to 75%) and will assess the borrowing level based on the rental income covering the mortgage interest by a definite margin of 125%.

As a result, a lot will depend on what you, as a landlord, hope to attain from your buy-to-let investment, as well as how relaxed you would feel making the mortgage payments whilst there is a void.(Interestingly, Direct Line calculated a few months ago that voids cost UK landlords around £3bn a year or an average of £1000 per property per year).

You also have to consider that interest rates could also increase, which would eat into your profit… although that can be mitigated with fixing your interest rate (as discussed above).

So, with everything that is happening in the world, does it really make sense to cash buy rental properties?

We support landlords to achieve their investment goals

At Bricknells Rentals we help both new and existing landlords work out their budgets and take into account other costs such as agent’s fees, finance, maintenance and voids in tenancy.

The bottom line is we as a country aren’t building enough property, so demand will always outstrip supply in the medium to long term, meaning property values will keep rising. That’s not to say property values might fall back in the short term, yet every time they have bounced back with vigour. Therefore, it makes sense to focus on getting the best property that will have continuing appeal and strong tenant demand.

This is an important point to conclude with: buy-to-let should be tackled as a medium to long term investment. Always! The wisest landlords see buy-to-let investment in terms of decades – not years.

As we mentioned above, we are here to help landlords in Rotherham and the rest of South Yorkshire so please do get in touch if you have any questions.