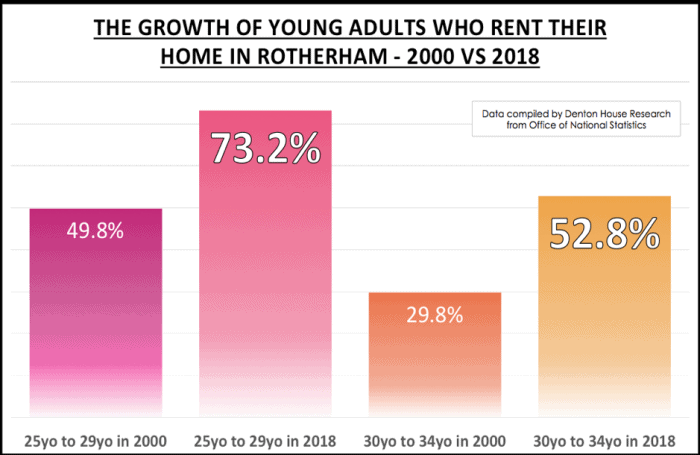

There is no escaping the fact that over the last couple of decades, the rise in the number buy-to-let properties in Rotherham has been nothing short of extraordinary.

The press has sometimes argued that landlords are hoovering up all the properties to build buy-to-let empires and that has stopped the younger generations from being able to buy their first home. The argument is that this has led to a whole subsection of young people who have been dubbed ‘Generation Rent’. In addition, there has been a lot of pressure on successive governments who have been blamed for giving landlords an unfair advantage with the tax system.

However, has the criticism of landlords been fair?

It was only a few weeks ago that we read a newspaper article in the Bricknells office about one landlord who had decided to sell their modest buy-to-let portfolio for a variety of reasons. One driving factor was the new tax rules on buy-to-let that were introduced last year. The comments section of the newspaper and the associated social media posts were filled with hate and certainly not deserved.

Like all aspects in life, there are always good and bad landlords, just like there are good and bad letting agents (we’re thankfully one of the highest rated ones in Rotherham!) Equally, it should be said that there are good tenants and bad tenants as well! Bad letting agents and bad landlords should be routed out but not at the expense of the vast majority who are good and decent.

Are the 2000+ landlords in Rotherham actually at fault?

It was the Conservative government in the 1980s that gave people the right to buy their council house – this took those properties out of the collective pot of social rented houses for future generations to rent. With no council houses left there was an explosion in privately rented accommodation in the early 2000s. Landlords have been vilified by many with the press claiming that their ravenous avarice has meant that they have operated at the expense of poor renters who are unable to buy their first home. However, we think there are at least seven reasons that created the perfect storm for the private renting explosion in the 2000s

1. The Housing Acts of 1988 and 1996

The Housing Acts of 1988 and 1996 gave buy-to-let landlords the right to remove tenants after six months, without the need for fault. Essentially this allowed banks and building societies to start to lend on buy-to-let properties knowing that if the mortgage payments weren’t kept up to date, the property could be repossessed without the issue of sitting tenants being in the property for many years. By 1997 buy-to-let mortgages were born and this is where the problems really began. This was not the fault of landlords but rather circumstances that the government created that allowed them to flourish.

2. The relaxation of lending criteria

In the early 2000s, those same building societies and banks began to relax their lending criteria. Landlords could provide self-certification meaning that they did not need to prove their income. In addition, mortgages could often be a huge 8 times the annual salary of a landlord. Finally, interest only mortgage deals helped to keep repayments inexpensive. The banks therefore deserve more blame for allowing private landlords to expand their portfolios rather than the landlords themselves.

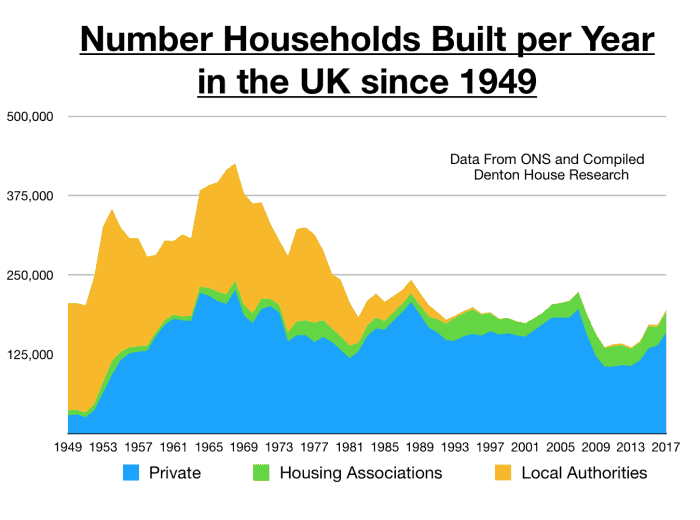

3. Not enough council houses have been built in the last 20 years

It’s easy to bash the Conservative government for their failure with Local Authority Housing since 2010 but can you believe that the Labour government only built 6,510 council houses in the whole of the UK between 1997 and 2010? Since 2010 there have been a further 20,840 which is woefully low when compared to the number built in the 1960s and 1970s. As a result, people who would have usually rented from the local council had no option but to rent privately. Again, this was not the fault of the landlords but a lack of foresight in government policy.

4. Less homes have been built in the last two decades

Not only are less council houses being built across the UK, the last 20 years has also seen a decline in the number of households built in general. The country currently builds less houses than are needed for our ever-expanding population. Less homes being built has inflated housing prices ensuring that younger generations have struggled to be able to get their foot on the housing ladder and have had to turn to private renting. Again, this is not the failure of landlords but instead a failure of government policy.

5. Pensions are worth less

Many of the landlords we work with at Bricknells Rentals are people who lost conviction in personal pensions. Many pension schemes have declined in value and as a result, those in their late 40s and 50s began to look for a better place to invest their savings for retirement. With the seemingly endless growth in housing prices, it made sense for these people to invest in buy-to-let property to guarantee a larger disposable income once they had retired.

6. Ultra-low interest rates for 9 years until the global financial crisis in 2008/2009

Interest rates were very low leading up to the global financial crisis which began 10 years ago in 2008. The Bank of England have set base interest rates independently of the Government since 1997. Although this was seen as a positive move at the time, those interest rates were very low which meant that borrowing was cheap. This resulted in many people borrowing money to get involved in the buy-to-let market. If borrowing had not been as cheap, an explosion in buy-to-let landlords would have been far less likely to happen.

7. An increase in EU migration since 2004

The biggest expansion of the European Union occurred in 2004. 10 nations joined including 8 Eastern European countries. This move brought around 1.4m people to the UK for work… and those people needed somewhere to live. This encouraged private landlords who were able to provide affordable rented accommodation for working immigrants. Again, this was not the fault of landlords. Instead, it was a small consequence of global and European politics.

The perfect conditions for an eruption in the private rented sector

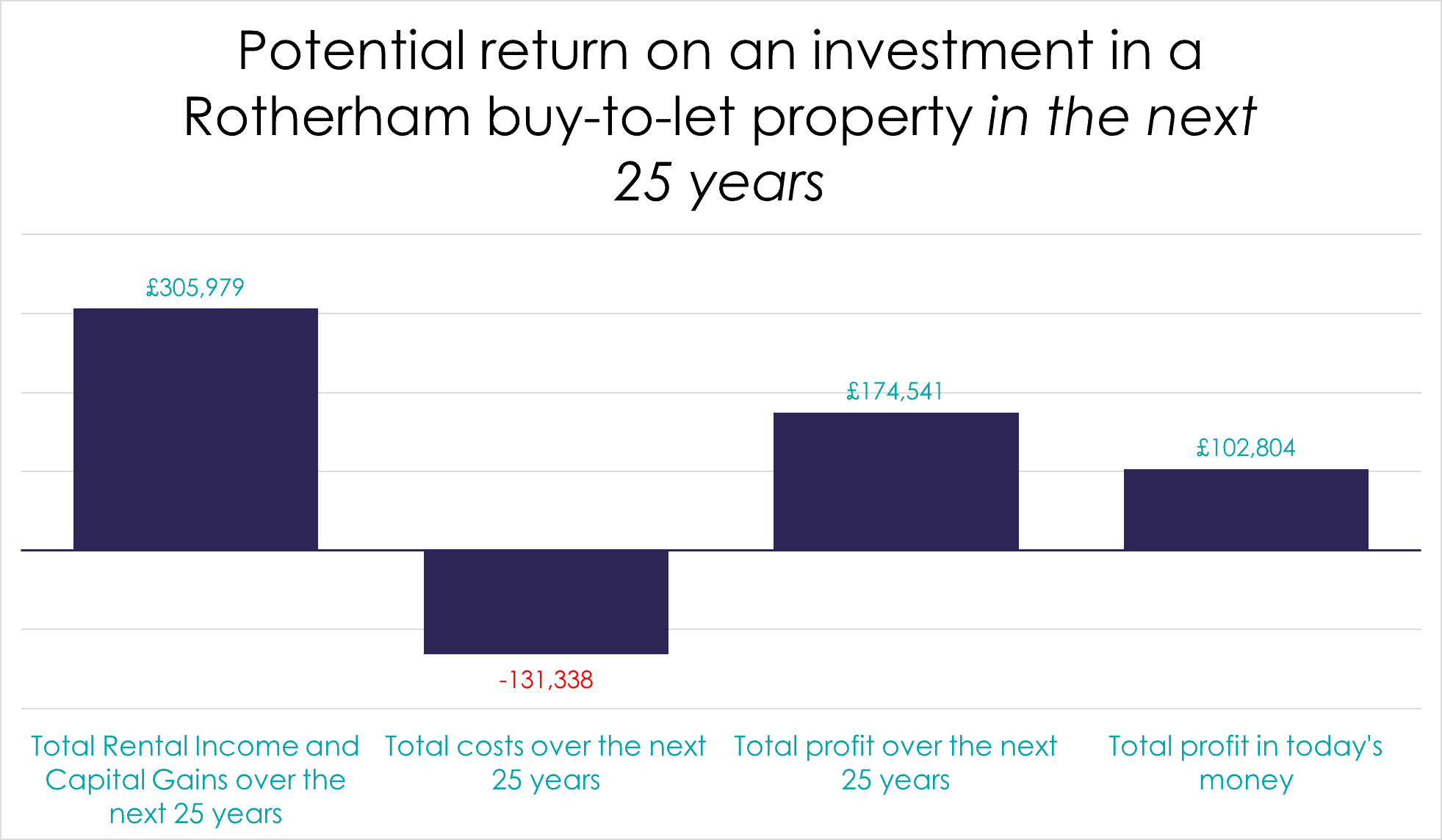

As you can see, many factors combined to allow the private rented sector to explode. And that is what happened in Rotherham! Commercially speaking, purchasing a Rotherham property has been undoubtedly the best thing anyone could have done with their hard-earned savings since 1998, where property values in have risen by 221.04%. Additionally, the average landlord could have earned up to £209,000 in rent since that period.

We hope that we have shown that blame cannot be laid at the feet of all buy-to-let landlords and that other factors have allowed them to . Yet the younger generation have definitely lost out. They are now often incapable to get on the property ladder (especially in London).

Over the last few years the Government have started to redress the balance by increasing taxes for landlords. Alongside this, the banks are now much tighter on their lending criteria meaning that the heady days of the early 2000s are long gone for landlords in our area. In the past 20 years, almost any buy-to-let investment made money – but not anymore.

How this has changed Bricknells Rentals

Being a letting agent has evolved from being a glorified rent collector to a trusted advisor giving specific portfolio strategy planning on each landlord’s buy-to-let portfolio.

We had a couple of instances recently of portfolio landlords in different situations – one wanted income in retirement from his buy-to-let properties, the other from Whiston wanted to pass on a chunk of cash to his grandchildren so that they can buy a home in 15 to 20 years time. Both of these landlord’s portfolios were woefully going to miss the targets and expectations, so over 2018, we have advised and helped them out. We sold a few of their properties, refinanced and purchased other types of Rotherham property to enable them to hit their future goals (because some properties in Rotherham are better for income and some are better for capital growth). That is what portfolio strategy planning is!

If you think you need portfolio strategy planning, we’re happy to help and advise you – whether you are a Bricknells landlord or not (in fact, the aforementioned Whiston landlord wasn’t!) Please give us a call or send us an email. All our details can be found on this website and we are happy to help!

Should you be considering a sale of your rented property to either deleverage and limit future tax liabilities or completely exit the buy-to-let, the team at Property Solvers would be happy to have a no-obligation chat. Please visit our

Should you be considering a sale of your rented property to either deleverage and limit future tax liabilities or completely exit the buy-to-let, the team at Property Solvers would be happy to have a no-obligation chat. Please visit our