I read an article from HouseSimple.com entitled: “Stuck in the past: The 17 Towns where house prices haven’t recovered from the financial crisis.”

Guess what? Rotherham was included in the list!

- In June 2007 average house price was £133,572

- In June 2017 average house price was £128,544

That’s a drop of -3.8%

So I thought I might investigate further:

I do agree with the findings of the article that several areas in the UK are experiencing house prices lower than the time of the credit crunch (August 2007) and the financial crisis of 2008.

Not unreasonable given the circumstances

However, a 3.8% drop from 2007/8 peak doesn’t seem unreasonable.

The most recent data from Land Registry has stated that property values in Rotherham and surrounding areas were 1.58% higher than 12 months ago and 9.12% higher than January 2015.

In the Rotherham property market, the number of properties available for sale has dropped significantly and this does have a positive effect on the short-term Rotherham property values as buyers have less choice and the dynamics of supply and demand take hold.

I suspect the uncertainty associated with the Brexit is encouraging people to stay put and improve their current accommodation rather than taking the risk to move.

However, even with this short term decrease in the number of properties for sale in Rotherham, I believe property prices will remain stable and strong in the medium to long term. Remembering property investment is a long-term strategy and the Yorkshire & Humber region is predicted to achieve a 10% growth (Savills) over the five years from 2017 to 2021.

The reasons why

If we look in detail at this imbalance we see that the number of properties on the market is way below the peak in 2008 when there were 1260 properties for sale compared to the current level of 954. Prices dropped by nearly 20% in the credit crunch years of 2008/9.

Less people are moving than a few years ago, meaning less property is available for sale. Fewer property for sale means property prices remain relatively high for a number of underlying reasons.

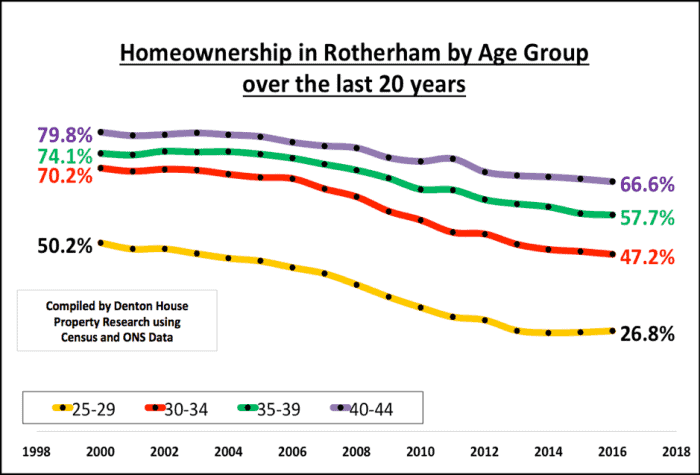

The increase in the private rental market has meant that stock held by private landlords are not sold as often as owner occupiers, thereby removing a number of properties out of the housing market selling cycle. Nevertheless, I will be interested to see how the recent tax changes will affect landlords, particularly those in the higher tax bracket and whether some landlords will exit the buy to let market.

The lack of local authority rental housing will further support the demand for private rented housing as people will always need a roof over their heads and if they cannot buy and the councils are not building anymore then only BTL landlords can meet the demand.

The tightening of mortgage lending rules and wages not keeping up with property prices mean that renting for some becomes the only viable option despite mortgage interest rates being low.

Stamp duty is higher compared to 10 years ago meaning that it costs more to move. This, coupled with the UK’s maturing owner occupier population, means that older people are less likely to move compared to when they were younger.

Finally, the underlying reason that we have a restricted supply of homes is simply that there are not enough being built. We need 240k houses a year to be built in the UK, but currently we are building just 145k.

A thought to conjure with is if we built more bungalows this would allow the older occupiers to downsize and thereby give some liquidity in the market. However, the problem here is that bungalows take up too much land to make them profitable for housebuilders and regrettably the impasse at the top of the property ladder will remain.

Improving the town centre will have a positive impact on Rotherham

Reviewing the article, it seems that most of the negative equity towns are in the North as oppose to the ‘Biggest Riser’ towns being mainly in the South and East.

I think desirability is another factor that influences an area’s property values. Centres of employment, university towns with high student demand, good connectivity and the positive perception of a place all increases the demand.

That’s why I feel it is important that Rotherham moves forward with its plans to develop and improve the town centre as a vibrant and attractive hub making investment attractive and adds to the general prosperity of its population.

It is difficult to predict the future and the EU situation creating uncertainty does not help. However, with the stock market at high and possibly heading for a correction I still think property is a good buy and deals are to be had.

That is maybe why we are receiving more interest from investors from London and the South who are interested in the Rotherham property market.

So, in conclusion the low supply and high demand is currently sustaining the local market and it is hard to see how the supply will increase in the short term, unless we fall off the Brexit cliff with a hard Brexit and EU citizens (owner occupiers and renters) all return home, thereby dumping lots of properties onto the market in a very short period that will drive house prices down. Surely that won’t happen but it does show just how important the Brexit negotiations are and that we get it right.

Hope that gives some food for thought.

Best regards,

Chris Holmes

Follow Bricknells on Facebook and Twitter for the latest information or visit our properties page for all the latest properties available for rent.