If you watch the national news you will notice that, especially when it comes to talking about the property market, it is incredible London-centric. In facts over the last 5 years, the London property market has really manipulated the UK on averages to such an extent that many lenders like the Halifax and Nationwide now publish two indices, one with London included and one without.

It is true that the London property market has undergone some acute property price falls. In the upmarket areas of Mayfair and Kensington, the Land Registry have reported values are 11.3% lower than a year ago, yet in the UK as a whole they are 1.3% higher. If you look around the different areas and regions of the UK and Northern Ireland, property values are up 5.8% year on year. More specifically, Yorkshire is 3.7% up.

So, what exactly is happening in Rotherham?

Well, to start with, as we have been saying for a while now, property is a long game, and making decisions on the short-term fluctuations is something that could cause a nervous breakdown. Landlords need to really consider this.

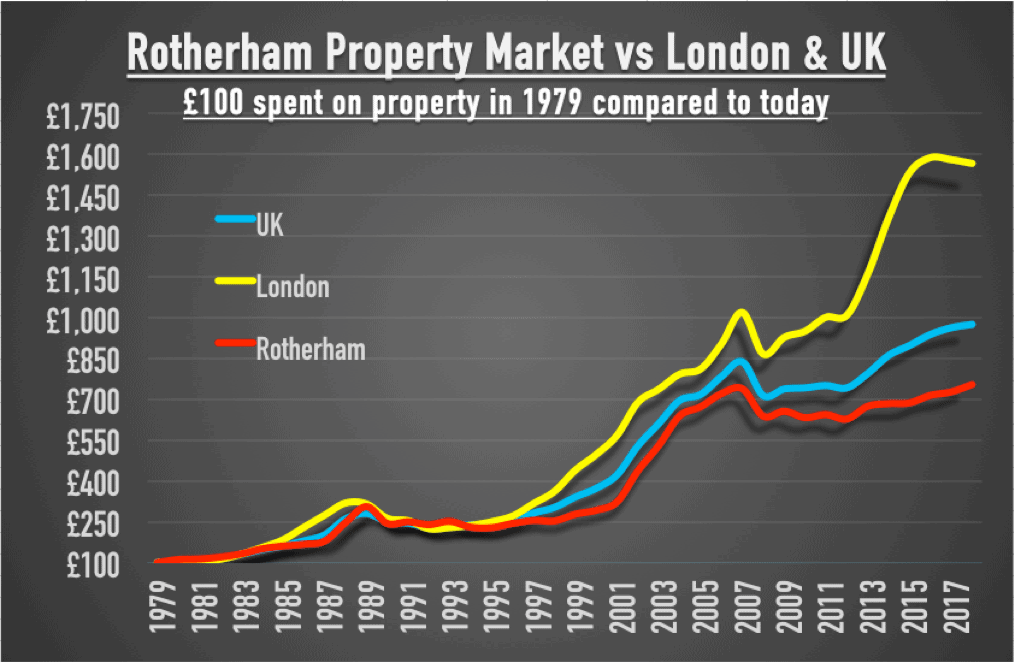

It’s interesting to compare Rotherham to London and the UK as a whole but this is quite hard to do as the average value of a property in Rotherham obviously differs significantly in comparison to the one in the capital. To compare like for like, we need to see what would happen if we had spent £100 on a property in London in 1979 and what that £100 would be worth today.

Therefore, let’s take a look at the last 40 years:

Can you see how the growth of that £100 was broadly similar between 1979 and 2007 on all three strands of the graph? After that the credit crunch caused a drop between late 2007 and 2009. After that time though, London has gone on a very different trajectory to the rest of the UK. Whilst Rotherham has continued to be generally subdued between 2009 and 2012, London pressed on. All areas of the country had a temporary blip in 2012 but, whilst Rotherham and the UK went up a gear again 2013, London went into overdrive and up like a rocket!

Are price falls likely to spread?

London has dipped slightly in the last year so the hot question for everyone has to be: are price falls likely to spread (as they did in the previous property recessions of 1989 and 2007) to Rotherham and other places in the UK? The Bank of England’s opinion is that a London house price drop is unlikely to be the beginning of a countrywide trend. Looking at the graph again, it can be seen London has been in decline for 2 years, whilst the rest of the country has been moving forward.

What does all this mean for Rotherham homeowners and landlords?

Well what happens in London does have an impact, but there are other issues that will have a bigger impact on the local property market. The simple fact is over the last 40 years, we have had 392.9% inflation. Looking at a typical Rotherham terraced house, it has jumped in value from an average of £9,089 to £97,800 since 1979 (a rise of 654.2%).

Property has, in the long term, been a good bet. Yes, we might have some short-term blips but as long as you play the long game – you will always win.

In the short term, our concern isn’t over monthly up or down property values, Brexit or another General Election. With property values still rising faster than salaries in many parts of the country, what really matters is how much of householder’s take home pay goes into housing costs as opposed to other spending items. If housing gets too expensive – other things will suffer, like holidays and the nice things in life to spend your money on. Only time will tell!

Whilst comparing Rotherham and London can be seen as a bit of fun, we are in the business of giving valuable advice to landlords – just take a look at our blog! If you are a landlord in need, please get in touch and we will do our best to provide you with our high quality advice.