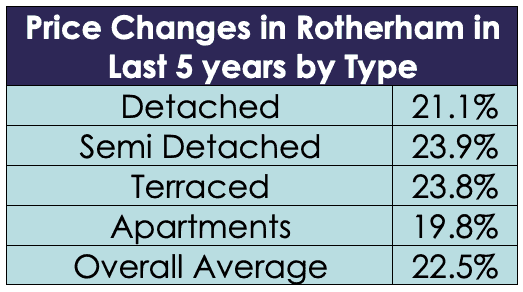

It’s good news for those landlords who have invested in the Rotherham property market with the long term in mind because prices have risen by 22.5% in the last five years. What’s behind this rise? Read on for our analysis.

Over the last five years we have seen some interesting, subtle changes to the local property market. In Rotherham, the buying patterns of landlords has changed ever so slightly. 12 months ago, 6,700 buy-to-let mortgages were granted (in the same month) for £900m. This means that the average was £124,200. However, looking at the last month, the lending figures were down… but not as much as you would think with the Brexit issue hanging over the country. In total there were 6,100 buy-to-let mortgages for a total sum of £800m, which is an average landlord mortgage of a respectable £131,100.

Compare both of these statistics to 2014, a boom year in the last decade. In 2014, in the corresponding month only £1,030 was borrowed on 8,300 buy-to-let properties, giving an average of £124,100. From these statistics, you could argue that it seems Brexit is having no effect on landlord buying habits.

What about Rotherham?

As we previously mentioned, the buying patterns in Rotherham have changed slightly.

Throughout 2018 we regularly spoke to more and more landlords. Some were seasoned professionals and some were first time landlords. Across the board, their attitude has been mostly positive. Instead of reading the scare stories, those Rotherham landlords look with their eyes and see a local property market that is doing reasonably well. There are medium term rents, property values rising and (as the above statistics identified) landlords that are still buying.

One question we get asked all the time is “what type of buy-to-let property should I buy?” We addressed this topic here in terms of the number of bedrooms, but today we would like to consider the money made from property through both the rent (expressed as a yield) and the actual value of a home.

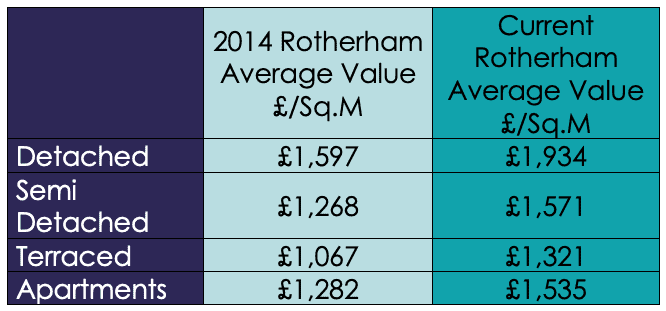

We have records of what each type of property (i.e. Detached/Semi/Terraced/Apartments) has achieved per square metre going back 20 years … and looking back over the last 5 years, these are the numbers:

It is clear that these all have a similar percentage uplift but there is some variation throughout. Although only slight, this can of course equate to thousands of pounds in monetary terms.

It can be seen that semis and terraced houses have performed the best. However, these are just averages. Landlords in Rotherham should always consider when the purchase of an apartment may be best for them. Whilst they haven’t been the best performers in terms of capital growth, they do tend to generate slightly better yields than a house (because, in general, several sharers can afford to pay more than a single family). Houses tend to appreciate in value more rapidly and may well be easier to sell because there are fewer houses being built.

Obviously we are talking in averages, but this gives a good place to start.

The bigger picture and why landlords are well positioned for the future

We must continue to consider the big picture.

Irrespective of what is happening in the world (Brexit, Trump, China, whatever…), people in Rotherham are still going to need a roof over their heads. As the UK hasn’t kept up with home building, even if we have a short term Brexit-related property value wobble this year, in the medium term demand will always outstrip supply and prices and rents will increase. The local council just doesn’t have enough money to fix the issue and the national government seems a bit pre-occupied at the moment. Therefore, as the population increases, the only people who can fulfil the demand is the private buy-to-let landlord.

Are you worried about the future?

Hopefully we’ve settled some nerves by looking at how competent the Rotherham property market seems to be at this moment in time. However, you will still be needing advice and guidance on where to invest your money or how to rent out your property most efficiently. That’s where we come in. We can take care of all your worries and give important, robust advice on the property market. Please get in touch to find out more.