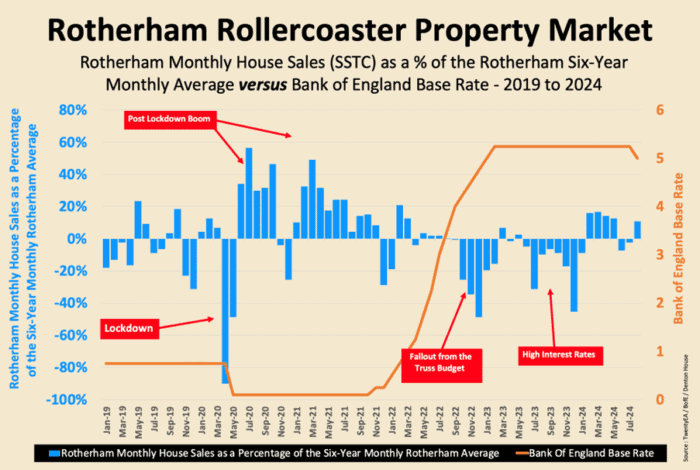

The Rotherham property market has experienced a rollercoaster ride since 2019, reflecting the unprecedented challenges and opportunities that have shaped the landscape of home buying and selling in the area. The accompanying graph vividly illustrates these dramatic fluctuations, comparing Rotherham’s monthly house sales, expressed as a percentage of the six-year (2019 to 2024) average in blue. Also on the graph in orange is the Bank of England’s base rate between 2019 to 2024.

By examining this six-year time frame, we can better understand the resilience of the local market and the influence of economic factors, particularly interest rates, on property transactions.

The Pandemic’s Impact and Post-Lockdown Surge

The first significant event highlighted in the graph is the pandemic and the lockdown in early 2020. The property market in Rotherham, like much of the country, ground to a near halt, with house sales in April 2020 alone plummeting by 90.1% below the 2019 to 2024 medium term six-year monthly average. The lockdown effectively froze the Rotherham property market, as restrictions made it difficult for people to view properties, secure mortgages, or move homes.

However, the Rotherham property market experienced a remarkable rebound once the lockdown measures were eased. The graph indicates a “Post Lockdown Boom,” with sales soaring in some months to 46.5% above the six-year monthly average by mid/late 2020. This surge can be attributed to pent-up demand, government incentives like the Stamp Duty holiday, and a renewed appreciation for home ownership as people sought more space and comfort during uncertain times. This period saw extraordinary activity, with many homes selling quickly and often above the asking price.

The Truss Budget and Rising Interest Rates

The Rotherham property market remained buoyant through 2021, although sales began to normalise in the later months of that year, fluctuating but still frequently staying above the long-term average. The shift in dynamics started in mid/late 2022, coinciding with the economic upheaval triggered by the “Truss Budget.” The budget, which led to market instability and rising mortgage rates, immediately impacted buyer confidence. As a result, Rotherham’s house sales dipped below the long-term average as potential buyers paused to reassess their financial positions.

Simultaneously, the Bank of England responded to inflationary pressures by increasing the base rate, as depicted in the graph. The sharp rise in interest rates through 2022 and 2023, peaking at around 5.25% in 2023, further dampened market activity. Higher mortgage rates reduced affordability, particularly for first-time buyers, and made it more challenging for existing Rotherham homeowners to move up the property ladder. The market cooled significantly, as seen in the negative sales percentages during this period.

Resilience and Recovery in 2024 in the Rotherham Property Market

Despite the headwinds of higher interest rates, the Rotherham property market in 2024 shows signs of resilience. The graph illustrates that even with these challenges, monthly sales have stabilised and are still above the long-term average, a testament to the underlying strength of the local market. It’s important to note that this average includes the exceptionally high sales volumes of 2020 and 2021, making the current performance even more impressive.

In-Depth Annual Data for Rotherham

Looking at the data for Rotherham estate agents in the postcodes S60/61/62:

- 2019 – An average of 114 properties sold (stc) per month in Rotherham, 5.4% lower than the long-term 6-year monthly Rotherham average of 121 property sales.

- 2020 – An average of 126 properties sold (stc) per month in Rotherham, 4.5% higher than the long-term 6-year monthly Rotherham average of 121 property sales.

- 2021 – An average of 141 properties sold (stc) per month in Rotherham, 16.9% higher than the long-term 6-year monthly Rotherham average of 121 property sales.

- 2022 – An average of 112 properties sold (stc) per month in Rotherham, 7.6% lower than the long-term 6-year monthly Rotherham average of 121 property sales.

- 2023 – An average of 106 properties sold (stc) per month in Rotherham, 12.6% lower than the long-term 6-year monthly Rotherham average of 121 property sales.

- 2024 YTD – An average of 129 properties sold (stc) per month in Rotherham, 6.5% higher than the long-term 6-year monthly Rotherham average of 121 property sales.

This sustained level of activity suggests that demand for homes in Rotherham remains robust, driven by factors such as the area’s appeal, the relative affordability compared to renting, and perhaps the normalisation of the work-from-home culture that allows more flexibility in where people choose to live. Furthermore, Rotherham sellers have become more realistic with pricing, and buyers who have adjusted to the new interest rate environment continue to move forward with their plans.

Looking Ahead: A Market of Opportunity

As we move deeper into 2024, the Rotherham property market presents opportunities for buyers and sellers. For sellers, the current conditions indicate that, despite higher interest rates, there is still strong demand for well-priced properties. On the other hand, buyers may find that the stabilising market offers a window of opportunity to secure a home before any potential further economic changes.

If you’re considering moving in the next 6 to 12 months, now might be the perfect time to explore your options. Whether you’re looking to downsize, find more space, or change your surroundings, I invite you to get in touch for a free, no-obligation valuation and market appraisal of your Rotherham home. Understanding the value of your Rotherham home in the current market is the first step to making informed decisions. Let’s discuss how I can assist you in navigating this dynamic market to achieve your property goals.

The Rotherham property market may have its ups and downs, but with careful planning and the right guidance, there are still plenty of opportunities to capitalise on this ever-changing landscape.